Annual Contribution Estimates

Annual Contribution Estimates

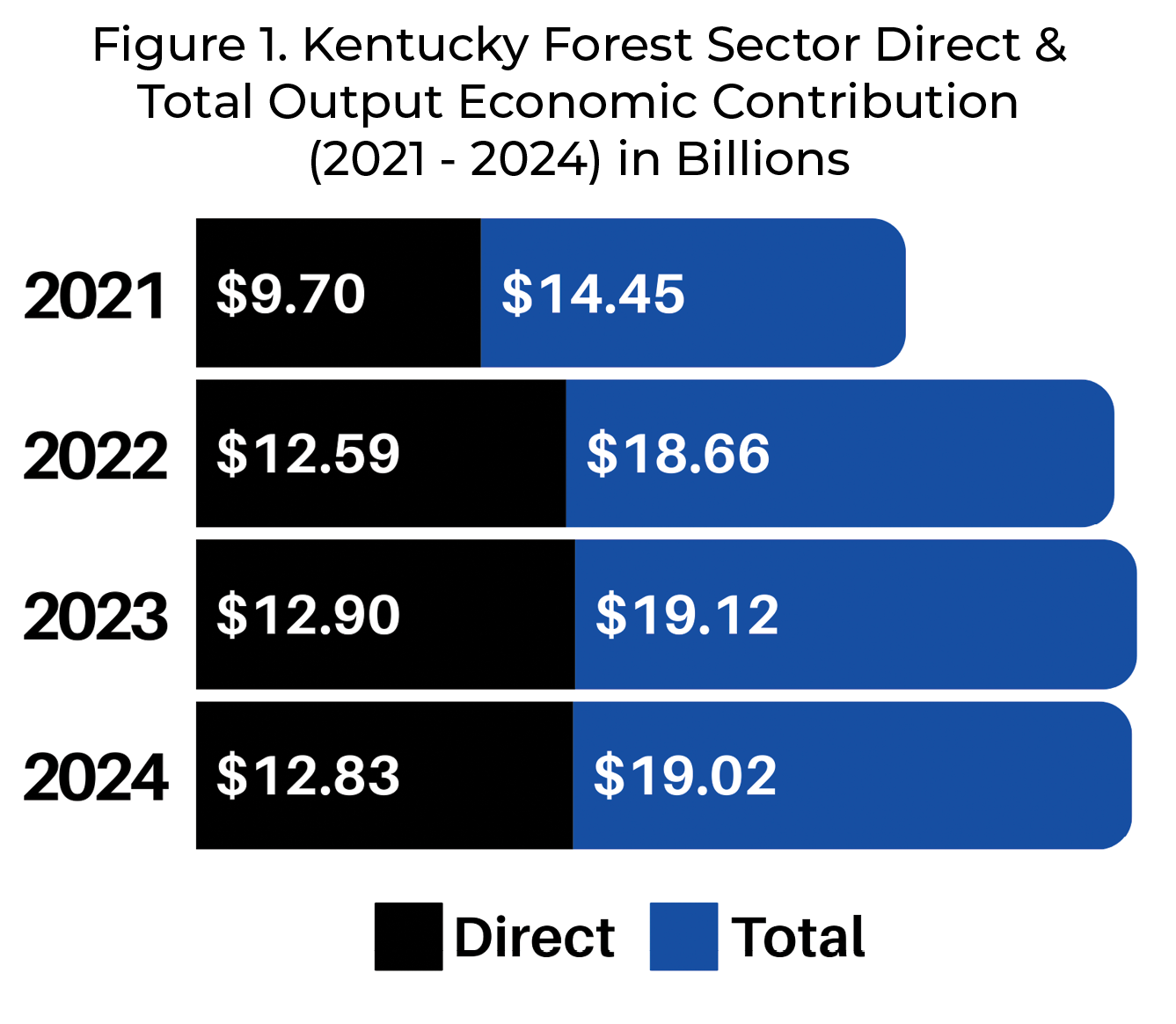

he total Kentucky forest sector contribution was $19.1 billion in 2023, the last year of available data, with an estimated $12.9 billion in direct contributions (Figure 1). Despite several facility closures, the contribution was up from 2022. This is largely due to increasing wages throughout all sub-sectors, continued strength of the stave and cooperage industry, and inflation tied to input costs. A lack of consumer demand for lumber products, inflation, and shortage of skilled labor continues to limit industry expansion. The downtrend in hardwood lumber and wood product markets within the forest sector are significant. In an attempt to increase domestic hardwood demand an industry-supported Real American Hardwood Coalition has been working to educate architects and consumers on the benefits of natural hardwood products (read more on page 14). The economic contributions of the forest sector are important across

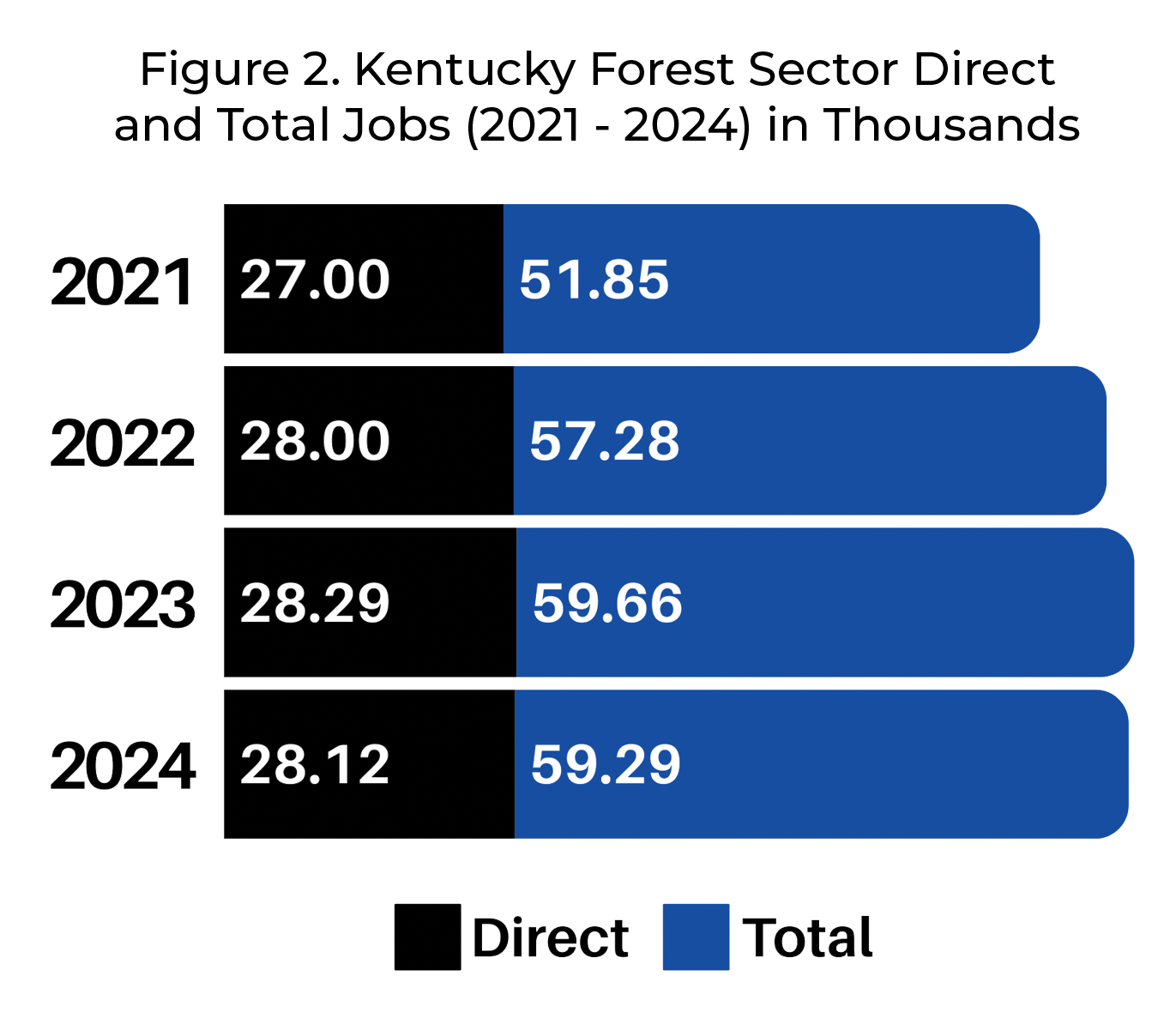

Forest industries employed 28,293 people in 2023 with indirect and induced employment resulting in a total of 59,664 Kentucky jobs (Figure 2). With a population of approximately 4.5 million, 1 in every 160 Kentuckians is directly employed in the forest sector. The direct labor wages for the Kentucky forest sector were $2.2 billion in 2023 with total labor wages reaching $4.2 billion. Multiple facilities have permanently closed in Kentucky and the surrounding region, including the largest sawmill in the state. Closure of this facility has effectively removed markets for landowners and timber extraction throughout most of southeast Kentucky. Kentucky’s forest industries continue to grapple with weak demand in hardwood lumber markets for several key species. Increased use of non-renewable materials like plastics in all sectors including housing continue to be the leading cause of decline in the forest sector nationwide. Rising inflation, rising wages for labor and the retirement of key leadership in the Kentucky forest industry further complicate matters. Rising wages is generally viewed as a good thing, however runaway inflation is aggressively impacting all aspects of cost of living which reduces the positive impacts of these adjustments.

2024 Forest Sub-Sectors Economic Contribution Estimates

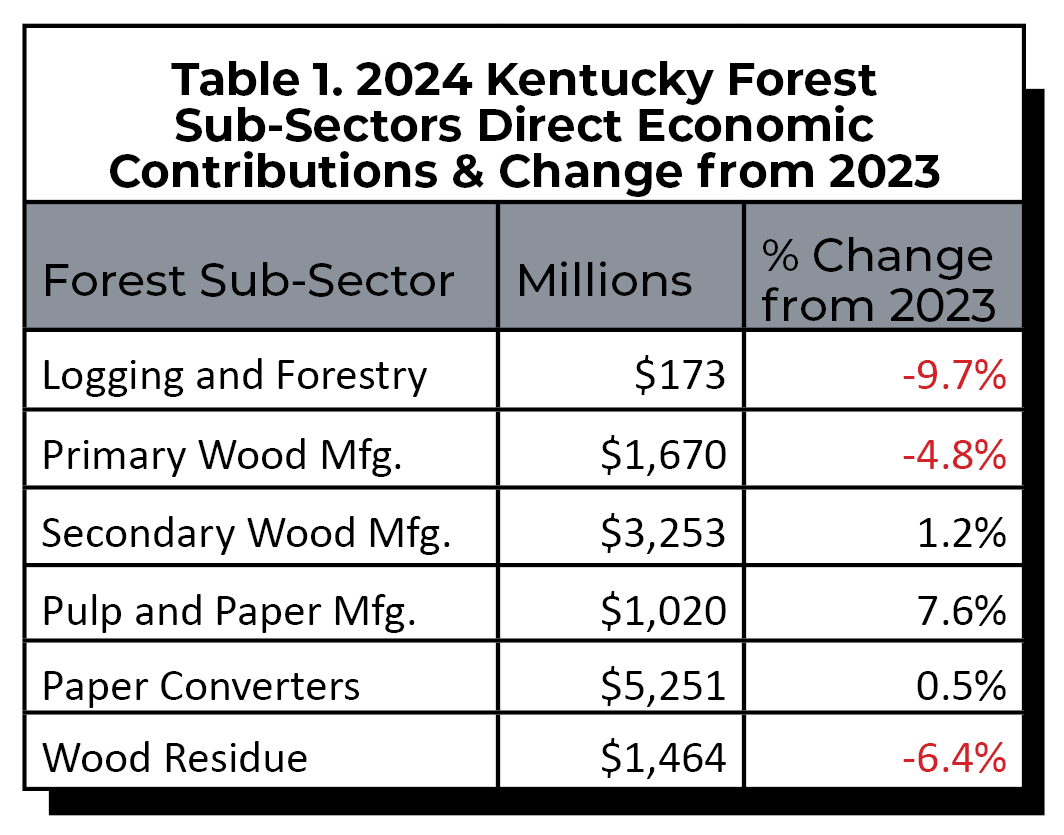

The 2024 Kentucky forest sector output estimates varied among sub-sectors with logging, primary wood manufacturing, and wood residue down by 9.7%, 4.8%, and 6.4% respectively, compared to 2023. However, secondary wood manufacturing, pulp and paper, and paper converters were up 1.2%, 7.6% and 0.5% respectively (Table 1). Volatile markets for logs and lumber continue to negatively impact the logging and forestry and primary wood manufacturing sub-sectors, which are also struggling with rising inflation. Widespread generational retirement will continue to occur in all sectors, this combined with a lack of workforce development is and will in all probability result in labor shortages that will remain a significant issue for the sector; with logging,

Economic Reports

Kentucky Forest Sector Economic Contribution Reports can be viewed separately at the links to the right.

Click on a link to the right...