Forestry Sector Taxes Paid

Forestry Sector Taxes Paid

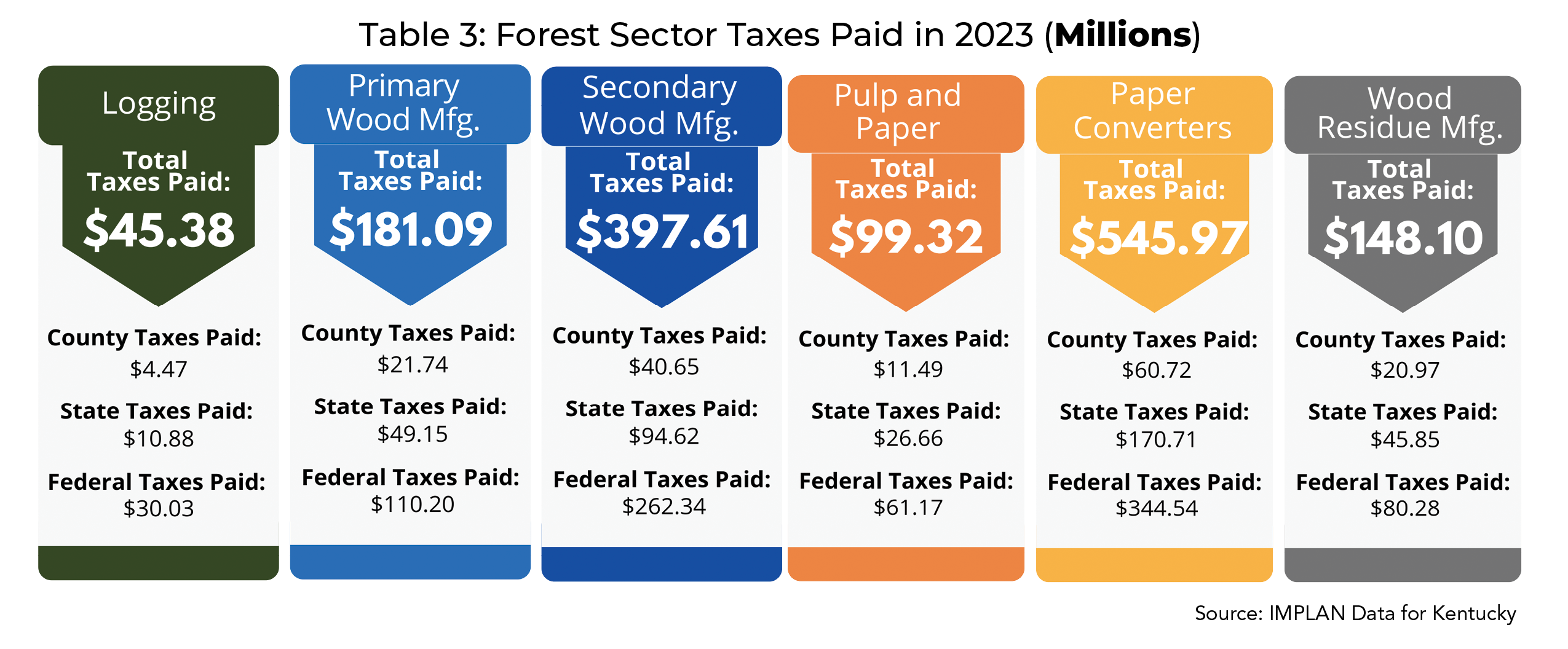

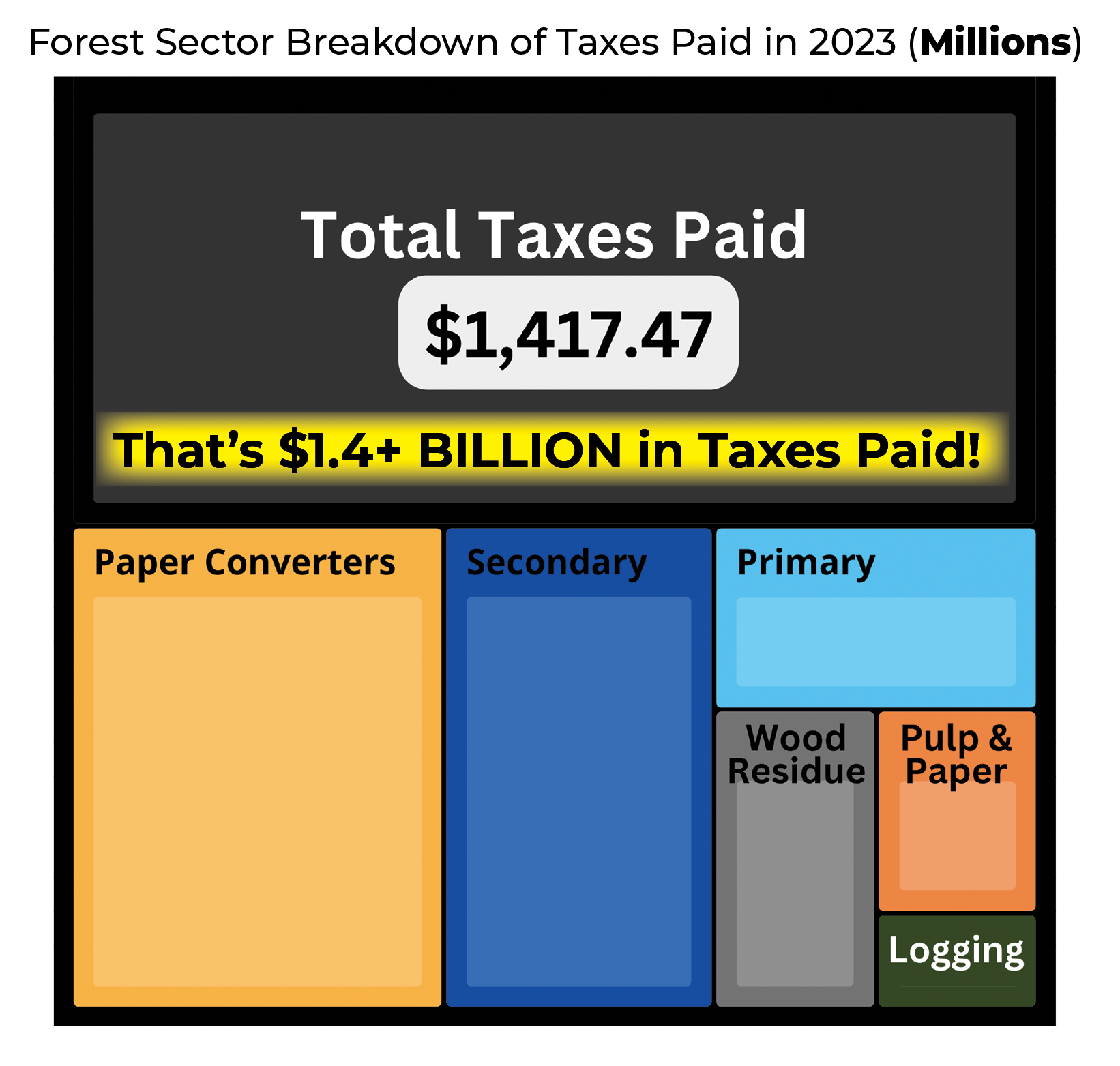

The Kentucky forest sector pays taxes at the county, state, and federal levels. County level taxes include: Sub-County General, Sub-County Special Districts, and County. Table 3 highlights the amount of total taxes (direct, indirect, and induced) paid by each of Kentucky’s forest sub-sectors. Examples of the taxes paid include: sales tax, property tax, motor vehicle license, social insurance taxes (such as Social Security) and custom duty taxes. Estimates for the 2024 tax year are not yet available.

Economic Reports

Kentucky Forest Sector Economic Contribution Reports can be viewed separately at the links to the right.

Click on a link to the right...