Delivered Timber Prices

Delivered Timber Prices

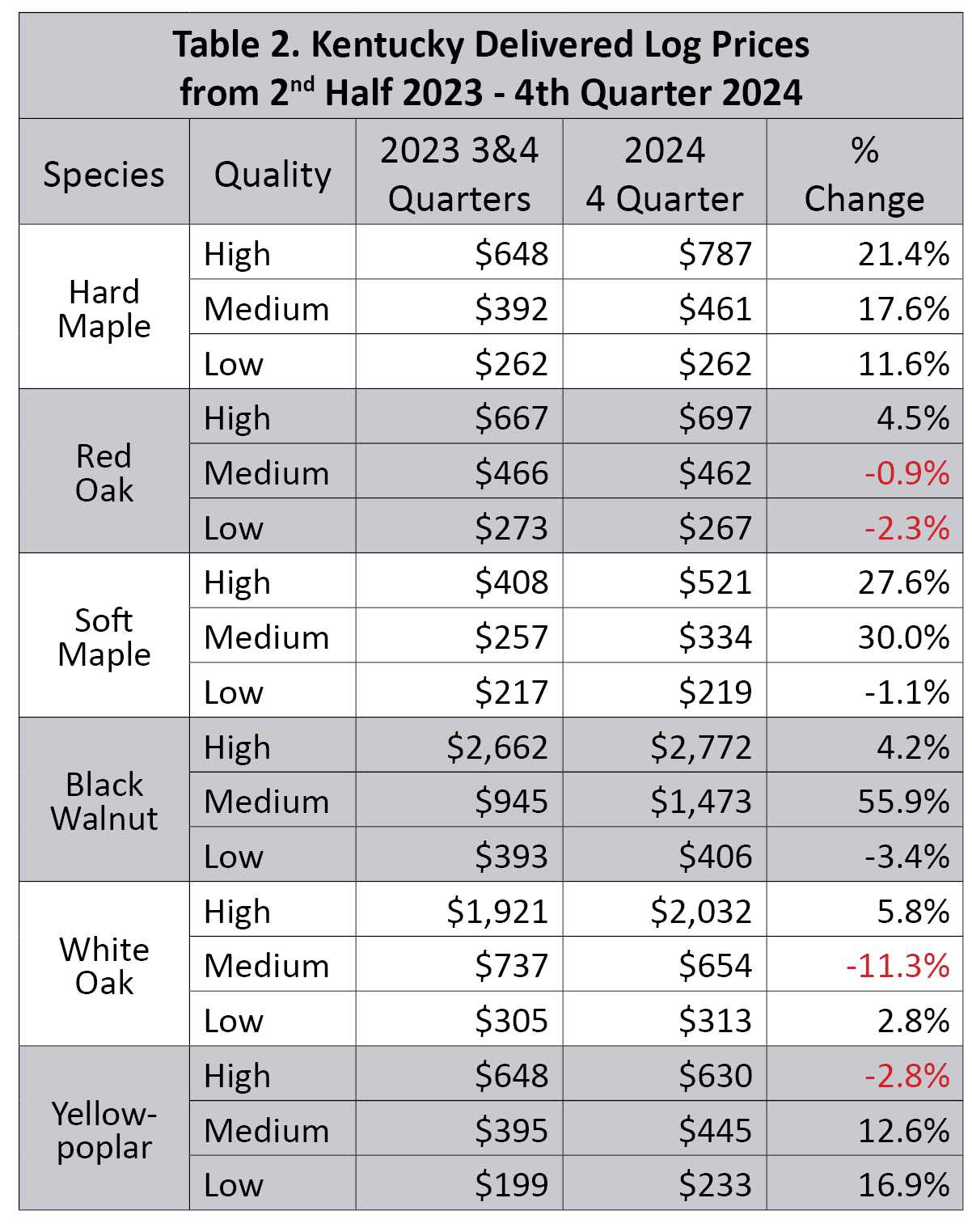

Hardwood lumber log market pricing has recovered significantly for most quality of logs and species in 2024; however, pricing has still not returned to levels set in 2021. Statewide averages for delivered log prices decreased by 16.6% from the 2nd half of 2022 to the end of 2023, when combining all grades and species. Red oak continues to struggle with marginal price improvement in high-quality logs and losses in medium and low-quality logs (Table 2). Log and lumber pricing and demand are tied to numerous factors including: decreased wood consumption due to increased non-renewable material usage in new home construction and remodel, elevated interest rates, decreased housing starts, business concern over the potential for a global economic recession, and rising inflation. While market pricing for delivered sawlogs and lumber show improvement, concern looms around potential impacts of increased tariffs and the impacts they could have on the struggling forest sector. Along with these broader market concerns, short falls in labor recruitment and retention continue. This issue is particularly troubling given that the profitability of logging and primary wood manufacturing industries is very challenging due to decreased hardwood market demand and value, which is reducing workforce capacity more rapidly. When hardwood demand increases the capacity to produce product will not be there, which will dramatically drive demand pricing upward. We continue to see a movement to more company logging crews and fewer independent loggers to ensure consistent wood supply.

Delivered Log Summary

Delivered Log Summary:

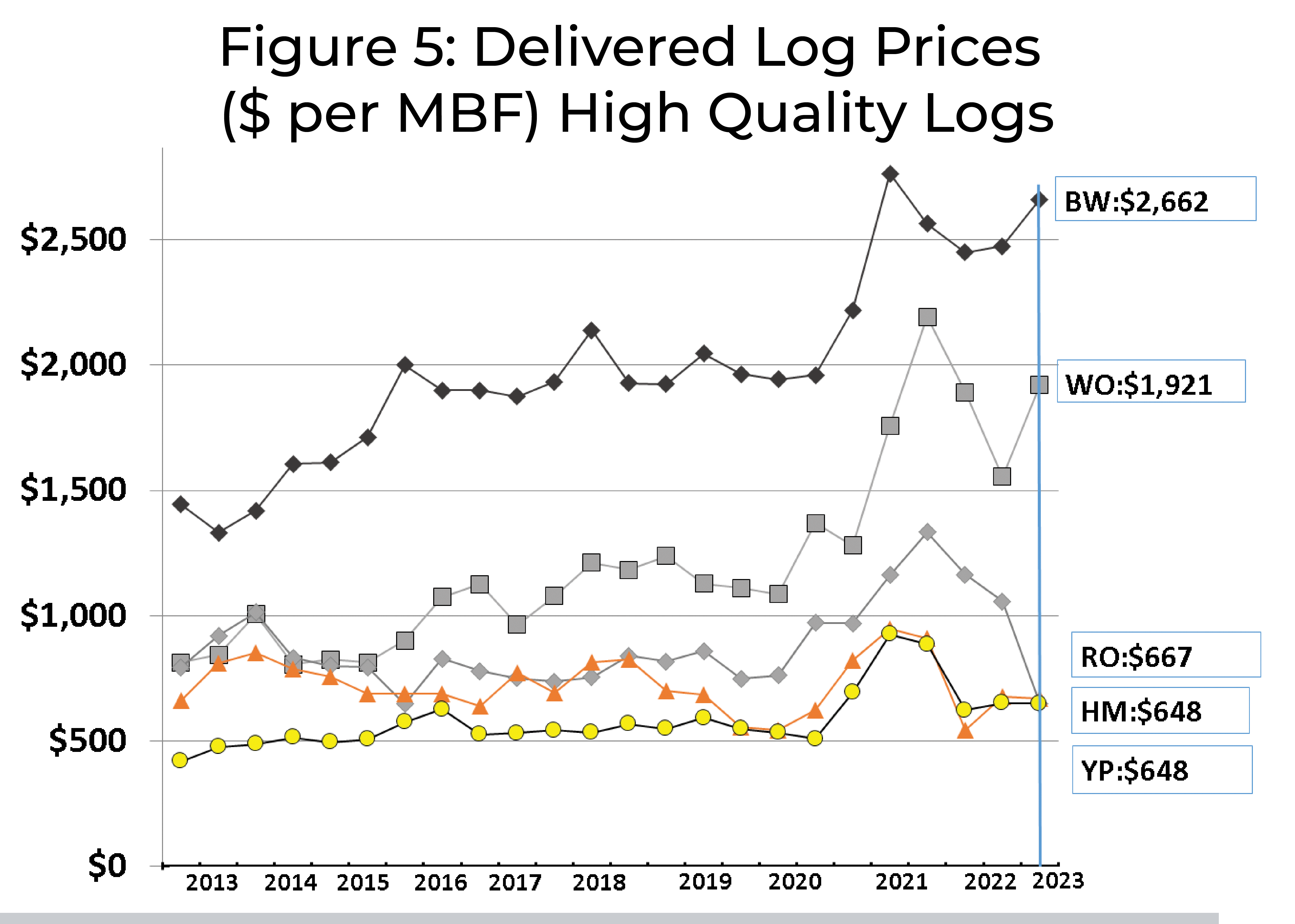

With the exception of yellow-poplar, high-quality hardwood log values increased in 2024. Indications from yellow-poplar consuming industries indicate that additional demand and price support will continue to improve for delivered logs in 2025. The downtrend for medium-quality logs was restricted to red and white oak species in Kentucky, reflective of the decreased pricing of railway tie logs throughout the region. Data from the top six species shows a general trend of improvement for most species and grades (Table 2).

White oak high-quality grade lumber log pricing increased compared to 2023, which shows increased competitiveness of lumber and stave markets. While high-quality lumber log prices are increasing they on average still remain lower than prices paid for white oak stave logs (Figure 6). In contrast, medium-quality logs decreased an average of approximately 11.3%. While high-quality lumber log prices are increasing they remain lower than prices paid for white oak stave logs. High-quality white oak lumber logs have not returned to the record high prices experienced in 2021, but are still elevated considerably compared to pricing in 2020 and prior (Figure 5). Low-quality white oak logs have increased slightly from 2023 by an average of 2.8%. The demand of white oak for many uses in products including veneer, stave, and grade lumber will keep competition and pricing strong for this species.

Black walnut experienced positive price trends across all quality of logs with high-quality lumber logs increasing slightly in value, and medium-quality logs seeing the most improvement increasing by 56% from 2023 to 2024. Low-quality logs saw marginal increase of 3.4% from 2023. Black walnut is our most valuable species historically and due to its unique appearance and limited availability will remain in demand.

Hard maple experienced significant improvement in pricing ranging from 12-21% across all log qualities from 2023 through the end of 2024. Hard maple pricing is significantly impacted by hardwood flooring and cabinet demand.

Yellow-poplar values for high-quality logs marginally decreased by 2.8%. However, medium and low-quality logs showed improvement in 2024, increasing 12.6% and 16.9% respectively. This is an important trend for Kentucky’s most abundant tree species.

Red oak high-quality log market demand is slowly improving from record lows in 2022. However, medium and low-quality logs continued to see marginal decreases in pricing averaging 1-2.3% decrease from 2023. Lackluster markets for flooring, cabinets, and millwork associated with housing starts and home remodeling due to the slowing housing market are partially to blame. Consumer preferences for species other than red oak and alternative materials also contribute to weakened lumber demand. The railroad tie market is partly cloudy with reduced pricing, but is still providing a consistent market for red oak logs at this time.

Stave Logs

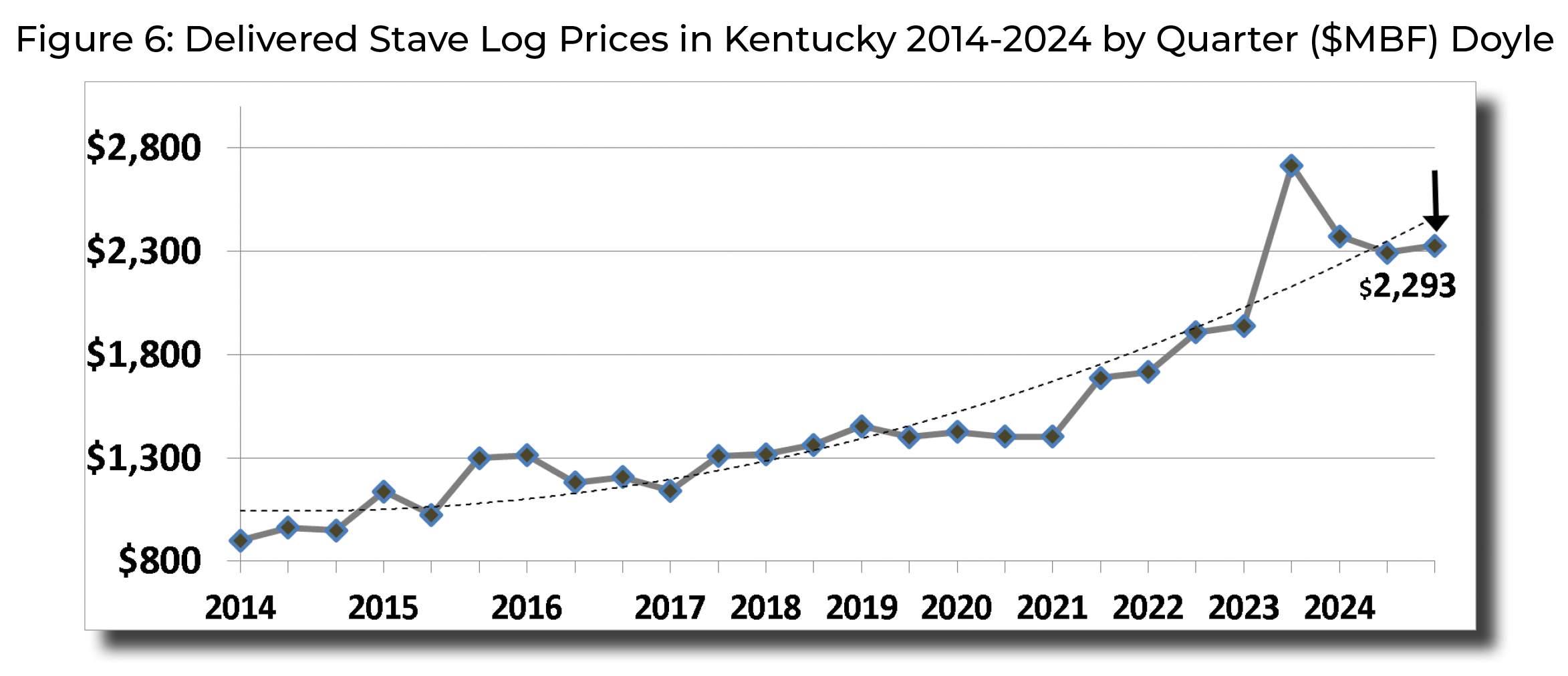

Strong pricing and competition between lumber and stave logs continued throughout 2024 despite recent concerns related to stave and cooperage mill closures. New equipment and technology upgrades to increase production of barrels and extending the use of available material have all been important investments to help improve utilization and meet the growing demand for new white oak barrels. Staves are the vertical pieces of wood that make up a barrel. They provide most of the flavor and all of the color imparted to bourbon.

Daily barrel production estimated ranges are now 14- 20,000 statewide, amongst all cooperages combined. Delivered stave log prices averaged $2.33 per board foot (Figure 6) statewide with logs ranging from .70 cents to $3/BDFT. Unlike most other commodities, stave logs experienced a 14.3% decrease throughout 2024. The market for stave logs is expected to remain strong in 2025

Railroad Tie Logs

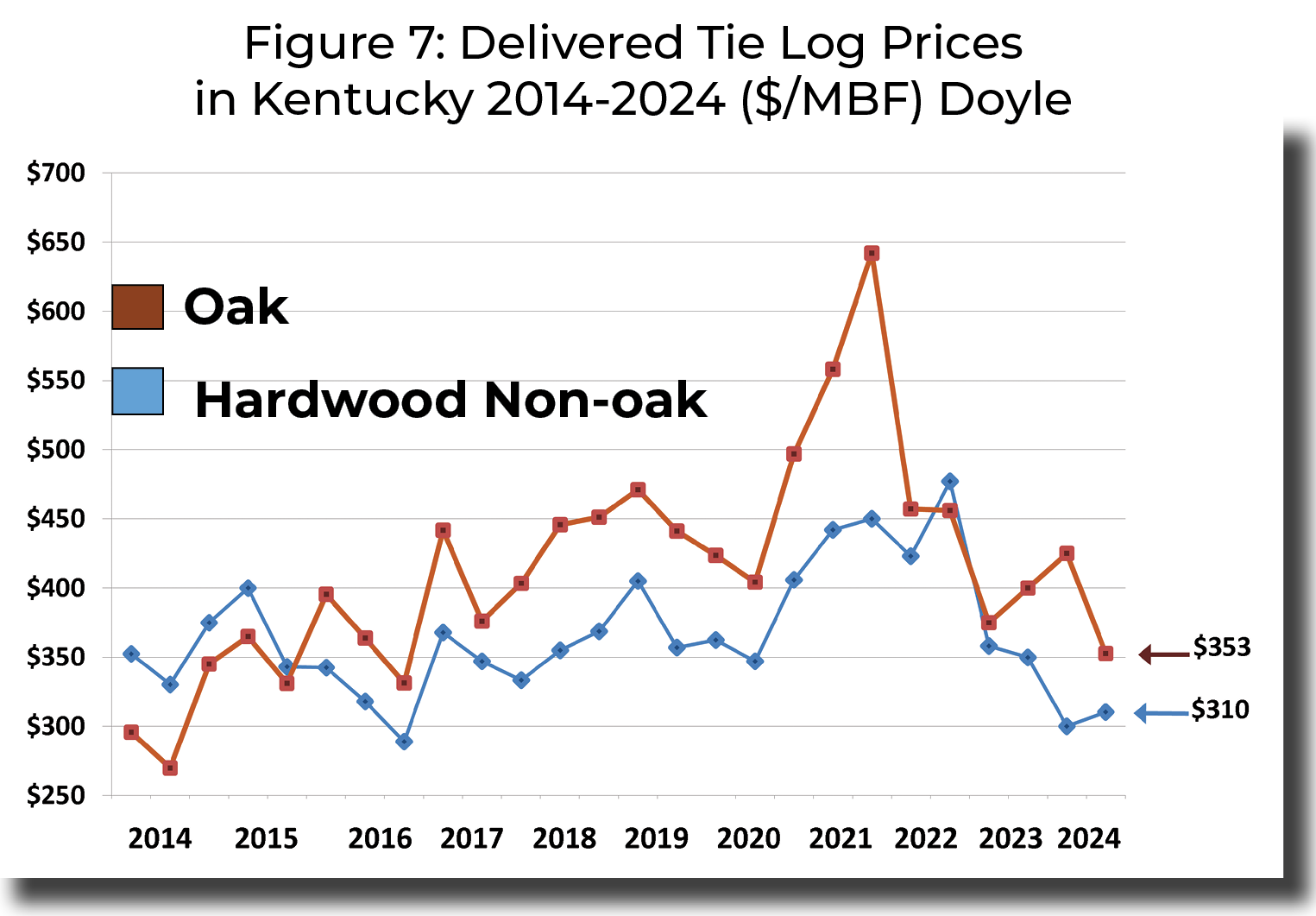

Railroad tie logs remain an important timber product in Kentucky. The market for hardwood railroad tie logs has softened in terms of pricing and purchasing (Figure 7). Regional impacts from Hurricanes Helene and Milton and forestland salvage efforts related to recovery from these storm events has lowered railway tie log prices due to temporary over supply. We have seen statewide a 5.9% price decrease for oak tie logs from 2023 to 2024. However, non-oak tie logs decreased by 13.3% statewide during the last year. The statewide average for non-oak railroad tie logs is $310/MBF while oak tie log average $353/MBF. Current on hand inventories reported by the Railway Tie Association are still showing procurement for all cross-tie products as balanced.

Economic Reports

Kentucky Forest Sector Economic Contribution Reports can be viewed separately at the links to the right.

Click on a link to the right...